Assessor Parcel Numbers

The numero uno way to find California parcel data.

Every parcel in the United States has a unique code assigned to it which is used by tax assessors as a kind of inventory number for tax purposes. These are most commonly referred to as Assessor Parcel Numbers, or APNs. You’ll also hear them called “APN numbers,” for the same reason people talk about “ATM machines.”

Other parcel number names include Assessor’s Identification Numbers (AINs), Property Identification Numbers (PINs), Property Identification Numbers (PIDs), Property Account Numbers or Tax Account Numbers.

Whatever you call them, APNs are a convenient way to locate and reference individual parcels. Whether you’re trying to find a property owner, get sales and property characteristics, or complete an assessment, you’ll want to get comfortable with finding and reading parcel numbers.

How to Read California Parcel Numbers

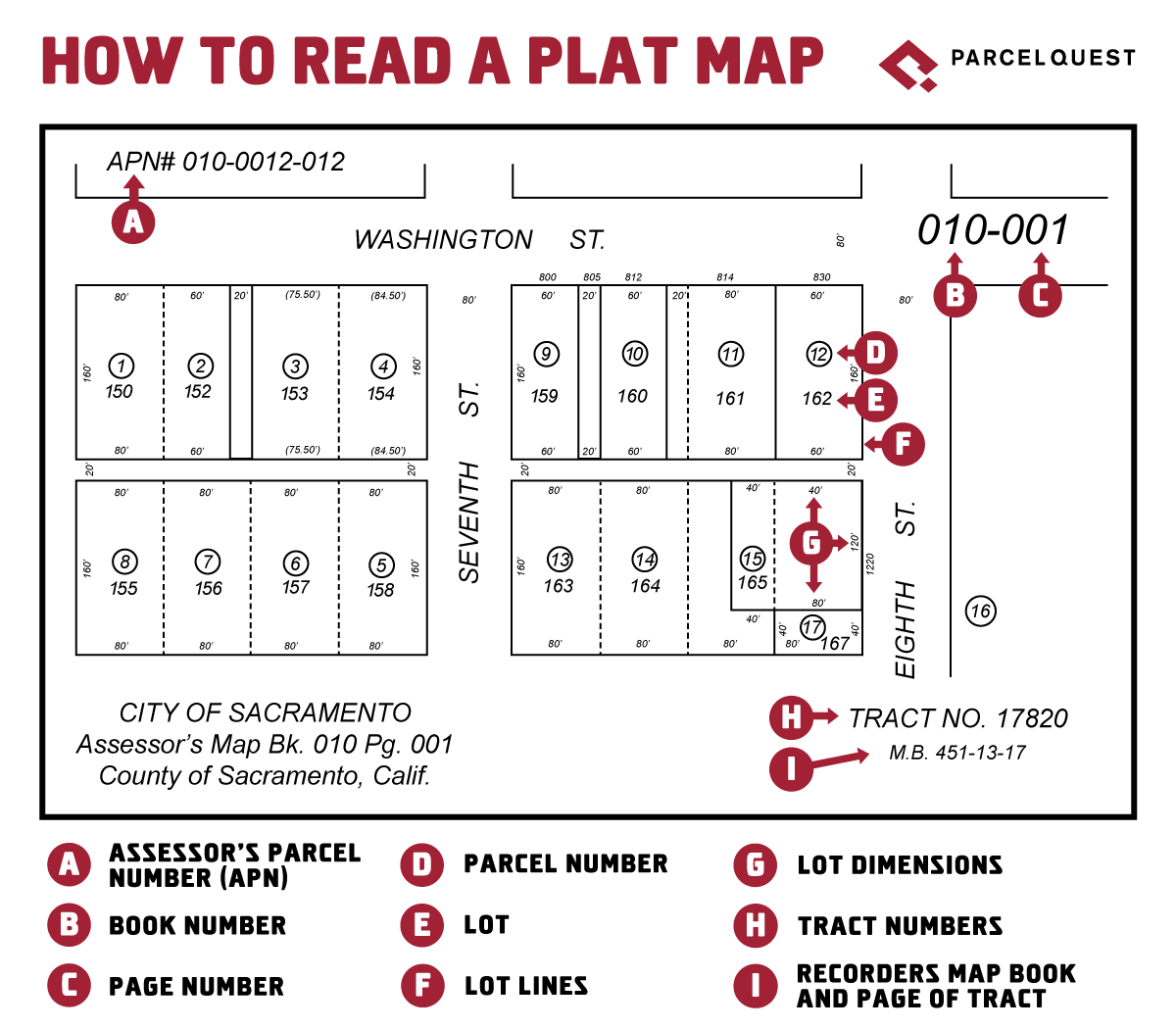

In California, APNs are used to inventory or identify a property. While the specific length and format can vary from county to county, APNs generally look something like the example below and help identify a parcel’s location on an assessor’s plat map.

Ex: 006-0153-011-0000

Although individual plat maps (pages) are now digitized in most counties, they were once organized into groups (books) for filing purposes, hence the terms ‘book’ and ‘page.’ The position of each number in the APN relates to the organization of the plat map.

In the above example, the first three numbers in the series (006) refer to the map book, which is the largest geographic unit within a county’s parcel numbering system. The next three numbers (015) refer to a specific map page within the map book. The seventh digit (3) represents a city block number, found on that map page. (Note that not all pages have blocks. If this is the case, the block digit in an APN will be a zero.)

The next three digits (011) refer to the specific parcel on a block or a page (if there is only one block on the page). Finally, the last four digits are all zero if the assessment represents a fee simple estate or absolute ownership. Numbers other than zeroes are used if the rights have been divided for assessment purposes (for example condominiums, possessory interests, and tax segregations).

Phew. That’s a lot. So now that you’re armed with this information, you probably have a better idea of how to read a parcel map and make sense of the parcel numbers you encounter. But how do you find the APN for a property to begin with?

How to Find an APN for a California Property

If you’re the property owner, the easiest way to find the parcel number is to look at the property tax bill. The APN will be listed there next to your personal information at the top of the first page. The parcel number is also generally printed on the deed of trust, title report, home appraisal, and various other documents of record for the property.

If you’re not the homeowner, or if you need to find parcel numbers in California for multiple properties, you’ll need to complete an APN search. The traditional method involves a few steps:

- Identify the county where the property you’re interested in resides.

- Search online for the county assessor for that California county.

- Hope that the county has an online property search tool and you don’t have to drive over to dig through maps and papers in person.

- Use the owner’s name or street address to find the parcel number.

- Repeat this process for each property you’re exploring.

Or, if you want a simpler way of performing California property searches, you can use ParcelQuest. Our robust search tools provide multiple ways to look up properties all over California, from searching by owner name or address to selecting parcels within a map area, comp search, and more.

ParcelQuest’s APN Lookup

When searching for property information at ParcelQuest.com, several search options make use of the APN. Whichever you choose to search by, we make finding what you need easier than Rickey Henderson stealing bases.

- Quick Search – Simply enter your APN to find your parcel of interest.

- Advanced Search – Search for a single APN or an entire list of APNs using the ‘Upload APN List’ feature. Save your list of APNs from Excel into a .csv file and upload it to the ParcelQuest search screen (we provide instructions if you need a little extra help with that). Click the ‘Search’ button, and every property from your list is automatically displayed on a map along with links to pages of ownership, history, tax data, and other helpful information. This can save you a ton of time when you need to conduct large searches for dozens, or even thousands, of properties. This is especially helpful if you need to quickly identify changes over time among the same large list of properties. It also allows you to run reports, do a mail merge, and print out mailing labels. You know, pretty much make life a whole lot easier on yourself.

- Radius & Sales Comps – As well as finding a subject property based on a real property address, you can find the property you’re looking for using its APN.

- Documents – Need to find a recorded document but don’t know the number? Search for the associated property by APN, address, or owner name, and quickly locate the document you want on our Docs & Sales History tab. Or, quickly grab all the parcels on an assessor map using the APN search field and enter just the book and page digits of an APN (see the sample above).

In our opinion, Assessor Parcel Numbers don’t get the recognition they deserve, yet they do a ton of heavy lifting when it comes to helping people like you find the property data they need. At ParcelQuest, we make sure every APN (all 13 million+ parcels of ‘em) packs the most punch to promptly get you the most accurate California parcel data possible.